Prescription charge refund procedure

Published on: 18th June 2013 | Updated on: 26th March 2025

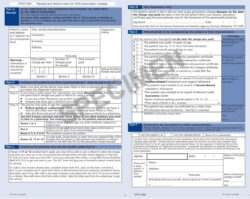

Following the introduction of the Hormone Replacement Therapy Prescription Prepayment Certificate (HRT PPC), the FP57 receipt and refund claim form has been updated. The new FP57 is now available to order, however, there will be a period of transition where pharmacies can continue issue the older versions of the FP57s forms until stocks run out.

Please note when using the old FP57, pharmacy teams should complete a separate FP57 for applicable HRT and non-HRT items. For items covered by the HRT PPC, pharmacy teams should annotate Part A with ‘listed HRT’ and initial the annotation. Patients with a valid HRT PPC should tick box F to claim a refund of HRT prescription charges. For more information see the ‘Issuing prescription refund and receipt forms’ section below.

Updated FP57s can be obtained directly from Primary Care Support England (PCSE) via the pharmacy PCSE Online supplies ordering portal.

The FP57 has been updated to allow pharmacists to record the number of charges paid for items on the HRT medicines list separately from other prescription items, and to address some outstanding required amendments for example, Part 5 (previously Part E) has been updated so the exemption categories are now in line with the FP10, by order and exemption box reference. The update also includes 2 new exemption boxes:

- box U for Universal Credit

- box W for HRT PPC

The prescription charges section has been updated on the new FP57 form. This lets the pharmacy teams record any charges for paid for items on the HRT medicines list separately from other NHS prescription items.

Full details of the prescription charge refund procedure can be found in Part XVI of the Drug Tariff.

- If the patient (or representative) requests one; or

- If the patient (or representative) is unsure whether they are entitled to free prescriptions; or

- If the patient (or representative) has applied or will be applying for a prescription charge exemption certificate or prepayment certificate.

If proof is required by the patient or representative to show that the charge was paid or for any reason other than the above, a till receipt may be sufficient.

The following notable changes have been made to the FP57 receipt and refund claim forms:

- Different parts of the FP57 form will be numbered instead of alphabetical. For example, Part A, B, C, D, E and F of the current FP57 form will be replaced with Part 1, 2, 3, 4, 5 and 6 respectively.

- The new FP57 now includes an additional row in Part 1 in which to record the charges collected for listed HRT medicines separately from any other charges collected for items not on the HRT medicines list.

- Part 4 (previously Part D) had been updated to include details of the issuer (the Ministry of Defence) of the war pension exemption.

- Part 5 (previously Part E) has been updated to align more closely with the letters used on the FP10 prescription form/token.

- Part 5 (previously Part E) now includes a new exemption box ‘W’, to enable patients to select when claiming a refund for listed HRT medicines.

- Part 5 (previously Part E) now includes exemption box ‘U’, to enable patients to claim a refund when included in an award of Universal Credit and meeting criteria.

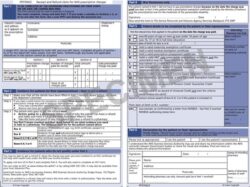

| Current FP571008 | New FP570423 |

|

|

Pharmacists can issue the patient (or representative) with an FP57 form at the time the patient pays the applicable charges if:

- a patient (or representative) requests one for any reason

- the patient (or representative) is unsure whether they a patient is unsure whether they are entitled to free prescriptions; or

- the patient (or representative) has applied or will be applying for a prescription charge exemption certificate or prepayment certificate (3-month PPC, 12-month PPC or HRT PPC); or

- the patient (or representative) is waiting for a paper certificate to arrive at the time they need their items

Please note if a receipt is required by a carer or representative, for example to show that the charge was paid, a till receipt may be sufficient proof. Refund claims must be made within 3 months from the date the charge was paid and the FP57 was issued. If more than 3 months have elapsed between the time the charge was paid and the FP57 form is presented for payment, the charges cannot be refunded unless the patient has a form LIS04(P) from the NHS Business Services Authority (NHSBSA).

An FP57 form should only be issued at the time the prescription charge is paid by the patient. The FP57 form cannot be issued at a later date. Part XVI Clause 7.5 of the Drug Tariff states ‘Only issue a FP57 Prescription Receipt and Refund claim form at the time the prescription charge is paid. If the patient or their representative is persistent in their request and they have grounds why they do not have a prescription refund and receipt, they should be advised to write to NHSBSA, Help with Health Costs, Bridge House, 152 Pilgrim Street, Newcastle Upon Tyne, NE1 6SN or ring 0300 330 1343, to explain why they were unable to obtain an FP57. Their Review Section will examine the claim and will either send a payment directly to the patient or advise the patient why they do not qualify.’

FP57 can be obtained from the Primary Care Support England (PCSE) portal. For a full list of what other stationary can be ordered from the PCSE portal then please see the Dispensing Factsheet – NHS stationery for community pharmacy obtainable from the Primary Care Support England (PCSE) portal (June 2016).

Prescription refund and receipt forms must be issued at the time the prescription charge is paid as later requests may be a fraudulent attempt to obtain another refund. Only authorised pharmacy staff should proceed to issue prescription refund.

Old FP57 (version FP571008) claim procedure

If a patient plans to claim a refund for an HRT item on the grounds that they held a valid HRT PPC that applied at the point of dispensing, or they were considering applying for a backdated HRT PPC and the new FP57 is not available the following steps should be followed:

- The patient would pay usual charges for all HRT and any non-HRT items and the prescription would be marked as ‘Paid’;

- An ‘old’ FP57 form must be completed on the date the charge was paid;

- The contractor or an authorised member of staff should complete Part A in full:

- Enter patients name and address as it appears on the prescription form;

- Stamp the ‘Dispenser’s stamp’ box;

- Complete all parts of section i to iii;

- Contractor or an authorised member of staff must annotate with ‘Listed HRT’ and initial the annotation to confirm the changes paid were for listed HRT items;

- Patients with a valid HRT PPC should tick box F;

- A sperate ‘old’ FP57 form should be issued for any non-HRT items.

- There must be no alterations to the amounts or the quantities in Part A (sections i, ii and iii). If a mistake is made, then start again with a new form and cross through the discarded form in such a way that it cannot be used and write, “CANCELLED” diagonally across it

- Once the patient obtains their HRT PPC, this can be presented at a pharmacy alongside the FP57 form within 3 months and a refund for the charges paid can then be issue to the patient

- The pharmacy providing the refund would complete the FP57 form and declare the total number of completed FP57 forms and total amount of charges refunded on the FP34C form via MYS.

Note: If the patient is in possession of a valid HRT PPC at the time of dispensing, then only charges for the non-HRT items should be collected and the FP57 form should be completed at the same time for the HRT medicines. This will avoid the need for the pharmacy to collect and refund charges for any HRT medicines supplied at the same dispensing episode. As the prescription is marked as ‘Paid’, the NHSBSA will deduct charges for all items (HRT and non-HRT) on the prescription and the pharmacy can re-claim the charges for the HRT medicines dispensed by declaring the number of FP57 forms submitted and total value of charges to reclaim via the end of month FP34C submission form on MYS

New FP57 (version FP570423) claim procedure

If a patient plans to claim a refund for an HRT item on the grounds that they held a valid HRT PPC that applied at the point of dispensing, or they were considering applying for a backdated HRT PPC, the following steps should be followed when using the new FP57 form:

- The patient would pay usual charges for all HRT and any non-HRT items and the prescription would be marked as ‘Paid’

- The new FP57 must be completed on the date the charge was paid

- The contractor or an authorised member of staff should complete Part 1 in full:

- Enter patients name and address as it appears s on the prescription form;

- Stamp the ‘Dispenser’s stamp’ box;

- Complete all parts of section i to iii for the listed HRT medicines and/or non-HRT items;

- Strike through any boxes not applicable i.e. if the patient is only paying for a listed HRT medicine strike through the line for ‘Item(s) not on Drug Tariff HRT only PPC list’.

- There must be no alterations to the amounts or the quantities in Part 1 (sections i, ii and iii). If a mistake is made, then start again with a new form and cross through the discarded form in such a way that it cannot be used and write, “CANCELLED” diagonally across it

- Once the patient obtains their HRT PPC, this can be presented at a pharmacy alongside the FP57 form within 3 months and a refund for the charges paid can then be issue to the patient

- The pharmacy providing the refund would complete the FP57 form and declare the total number of completed FP57 forms and the total amount of charges refunded on the FP34C form via MYS

Note: If the patient is in possession of a valid HRT PPC at the time of dispensing, then only charges for the non-HRT items should be collected and the FP57 form should be completed at the same time for the HRT medicines. This will avoid the need for the pharmacy to collect and refund charges for any HRT medicines supplied at the same dispensing episode. As the prescription is marked as ‘Paid’, the NHSBSA will deduct charges for all items (HRT and non-HRT) on the prescription and the pharmacy can re-claim the charges for the HRT medicines dispensed by declaring the number of FP57 forms submitted and total value of charges to reclaim via the end of month FP34C submission form on MYS.

Pharmacists in England may process refunds for prescription refund and receipt forms issued in England, Scotland or Wales.

Pharmacists in Wales can only make prescription refunds on Welsh receipt and refund forms (WP57).

Authorised member of staff should accept prescription refund and receipt forms:

- If it was issued at another pharmacy; or

- If the form was issued by a hospital or other NHS organisations including a dispensing doctor or appliance contractor.

A prescription refund without an FP57 can only be considered in exceptional circumstances. If a patient believes they have an exceptional circumstance for not collecting a FP57 receipt at the time of payment, they can write to NHSBSA to request a refund.

Proof of payment and a covering letter outlining the circumstances should be sent to:

Good Cause Reviewers

HES

NHSBSA Bridge House

152 Pilgrim Street

Newcastle upon Tyne

NE1 6SN

nhsbsa.healthcostrefunds@nhs.net

Or telephone 0300 330 1343, to explain why they were unable to obtain an FP57. The claim will be reviewed and either a refund will be authorised by sending form LIS04(P) or the patient will be advised if they do not qualify.

When a patient presents a prescription refund and receipt form for payment, pharmacy staff should proceed as follows:

- Check the serial number on the form to ensure it is in the same format as the forms held by that pharmacy (old style FP57/WP57 (0403) versions of the form may also still be processed);

- Check that there are no alterations to the amounts or quantities in Part A and the form appears genuine;

- Check if the patient is included in an award of Universal Credit – if they are, they should tick box 11 for income-based jobseeker’s allowance, until the prescription forms are updated, and show their Universal Credit award notice as evidence (see Part XVI Notes on charges in the most current Drug Tariff for full requirements of pharmacy staff — for patients claiming a refund based on the Universal Credit exemption arrangements);

- Check that the claim is being made within three months of the date the charge was paid, (e.g. if charge is paid 1 January, the refund must be claimed by 31 March), or the patient has an authorised form (LIS04(P)) from the NHS Business Services Authority (NHSBSA), Help with Health costs;

- Request evidence of entitlement to exemption or sight of form LIS04(P) authorising payment;

- Check that the evidence relates to the patient;

- Check that the evidence covers the date on which the charge was paid;

- Note on the form what evidence was produced;

- Where applicable, note on the form the reference number on the exemption document;

- Where applicable, note on the form the LIS04(P) form reference number and date;

- Ask the person claiming the refund to print their name and address on the form (or the representative’s details where appropriate).

If the above is all is in order, the pharmacy should pay the amount shown in Part A of the form and ask the patient or their representative to sign and date the form. A member of staff authorised to make refunds should also sign and print their name on the form. If the form is not in order the pharmacist should telephone the prescription, NHS Protect fraud line number on 0800 028 4060 (England) or CFS Wales on 01495 745844 (Wales).

Form FP57 is valid for three months from the date of issue. If more than three months have elapsed and they do not have an LIS04(P) form, patients will need to send the FP57 form to:

NHSBSA,

Help with Health Costs,

Bridge House,

152 Pilgrim Street,

Newcastle upon Tyne,

NE1 6SN

They must also send a letter explaining why they did not claim the refund within the three-month time limit. The claim will be reviewed and either a refund will be authorised by sending form LIS04(P) or the patient will be advised if they do not qualify.

In England, pharmacy contractors are required to submit forms to the NHSBSA at the end of each month along with their prescription bundles being submitted for payment. Contractors should declare the number of FP57 refunds submitted each month and the total amount refunded on the FP34c using MYS.

In Wales, paid forms should be sent to Powys LHB via the Business Services Centre local offices in the normal way.

Contractors are reimbursed for the amount refunded to the patient, one month after the FP57 refund has been declared on the FP34c MYS portal. For example, if a refund was made during April and submitted to the NHSBSA before the 5th of May, the contractor would be reimbursed for that refund on the 1st June.

Additionally, the Department of Health and Social Care added £200k to the total contract sum, to fund the administration workload of issuing prescription charge refunds. The funding is distributed in proportion to prescription volume rather than as a specific fee per refund.

FAQs

FP57 can be obtained from the Primary Care Support England (PCSE) portal. For a full list of what other stationary can be ordered from the PCSE portal then please see the Dispensing and Supply factsheet: NHS stationary for community pharmacy obtainable from the PCSE portal.

Form LIS04(P) is sent to the patient by NHSBSA, Help with Health Costs and issued to allow authorised pharmacy staff to process late refund claims. In the event of late claims, patients will need to send the FP57 form to:

NHSBSA,

Help with Health Costs,

Bridge House,

152 Pilgrim Street,

Newcastle upon Tyne,

NE1 6SN

They must also send a letter explaining why they did not claim the refund within the three-month time limit. The claim will be reviewed and either a refund will be authorised by sending form LIS04(P) or the patient will be advised if they do not qualify

Yes. Regulation 96 of the NHS (Pharmaceutical and Local Pharmaceutical Services) Regulations 2013 (the Regulations) states: “Where any person who is entitled to a repayment of any charge paid under the Charges Regulations presents an NHS pharmacist with a valid claim for the repayment within three months of the date on which the charge was paid, the NHS pharmacist must make the repayment.”

The Regulations require pharmacy teams to make refunds against prescription charge receipts issued in England (FP57 Forms). Part XVI Notes on charges in the Drug Tariff* states “Pharmacists in England may process refunds for prescription refund and receipt forms issued in England, Scotland or Wales”. The paid FP57 form will be sent to the NHSBSA in the normal way.

(* August 2016 Drug Tariff)

No. Welsh pharmacies will not be reimbursed for issuing cross-border refunds. If a patient presents a completed FP57 claim form for refunding at a Welsh pharmacy, then the community pharmacist must inform the patient that they are unable to make a refund and that they should present the FP57 form at a community pharmacy in England for refunding.

To issue a refund, it is necessary for you to see the actual prepayment certificate. The reference number and date issued is not definitive proof of exemption. FP57 forms are valid for three months and if the patient has recently applied for the certificate they should wait for the certificate to be received and then return to the pharmacy for a refund. The patient should receive the certificate well before the three months have expired.

No. Whilst Regulation 96 of the NHS (Pharmaceutical and Local Pharmaceutical Services) Regulations 2013 refers to a requirement for NHS pharmacists to issue refunds, there is no corresponding provision relating to dispensing doctors.

The HRT PPC certificate is non-refundable, so patients must check this type of certificate is suitable for them before they purchase it. Patients can call 0300 330 2089 for help and support.

Tax credit payments made by HM Revenue & Customs (HMRC) ended on Saturday 5 April 2025. To continue being entitled to free NHS prescriptions, patients must meet the Universal Credit criteria for help with health costs or qualify under another valid exemption reason. Patients can be directed to the NHSBSA eligibility checker to check if they are entitled to free NHS prescriptions.

If a patient is unsure of their entitlement to free NHS prescriptions, pharmacy staff should advise the patient to pay for their prescription and provide them with an FP57 receipt and refund form at the point of payment. To claim a refund, the patient can return to any community pharmacy with their FP57 form along with evidence of their entitlement to free NHS prescriptions.

Related Resources

Exemptions from the prescription charge

Dispensing Factsheet: Exemptions from the prescription charge

Prescription Charge Card and Multi Charge Card

Prescription form section of the NHSBSA’s website (external)

For more information on this topic please email comms.team@cpe.org.uk