Discount Deduction

Published on: 18th June 2013 | Updated on: 19th March 2025

Changes to the discount deduction scale were implemented by the Department of Health and Social Care (DHSC) in October 2022. This page explains why the changes were introduced and how the current discount deduction system works.

Each month, the NHSBSA reimburses pharmacy owners for the products they dispense, less an amount of discount deduction or ‘clawback’. The monthly ‘clawback’ amount is calculated according to a discount deduction scale (in Part V of the Drug Tariff) which determines an assumed amount of discount received by pharmacy owners to avoid them having to individually calculate and declare the discount received on each item dispensed. Items listed within the ‘Drugs for which discount is not deducted’ list in Part II of the Drug Tariff do not have any discount deduction applied.

The current discount deduction system is split into three groups: ‘Generics’, ‘Brands’, and ‘Appliances’. The deduction rate for each group is a fixed value. The deduction rate for each group is:

- Generic medicines (excluding those granted a price concession*) – 20.00%

- Branded products – 5.00%

- Appliances – 9.85%

* Discount deduction does not apply to price concessions for the month in which they are granted.

Discount deduction is less on average than actual margins achieved by pharmacy owners. The margin retained by pharmacy owners is measured using the margins survey and forms part of the overall margin pharmacies are allowed to retain as part of the contract sum each year.

The table below outlines the deduction rates applicable to different product groups.

| Group | Definition and products covered by the definition | Discount deduction rate |

| Generics | Products listed in Category A and M of Part VIIIA of the Drug Tariff (excludes products granted price concessions for the given dispensing month) |

20% |

| Brands | All products not covered by Appliances and Generics groups This includes:

|

5% |

| Appliances |

Products listed in Part IX of the Drug Tariff This includes:

The Appliances deduction rates applies whether the appliance is prescribed by brand name or generic name. |

9.85%

|

Previously, the discount deduction scale was based on the monthly total of prices paid to pharmacy contractors with a minimum of 5.63% and a maximum of 11.5% deducted from the monthly total. In that system, pharmacies with lower total monthly reimbursement experienced a lower rate of deduction whereas pharmacies with higher total monthly reimbursement experience a higher rate.

After an extensive examination of the evidence available to both Community Pharmacy England and DHSC, from the pharmacy margins survey and other sources, found there was no evidence to suggest that the discount rates obtained by pharmacies correlated with the monthly reimbursement of those pharmacies. As there was no discernible relationship between discount levels and monthly reimbursement, Community Pharmacy England and DHSC agreed that fixed deduction rates would be applied instead of sloped scales.

Following a public consultation in 2019, DHSC implemented a fixed rate deduction scale for three different product groups to try and achieve a more equitable distribution of margin and reduce the dispensing of branded products at a loss in recognition that brands, typically, do not attract the same level of discounts as generics. Under the current system, all pharmacies have the same fixed rates of deduction applied to reimbursement of items in each of the three product groups, regardless of the total value of their monthly reimbursement.

One of the problems with the previous single sloped deduction scale was that it reimbursed all items equally and did not take a pharmacy’s ‘dispensing mix’ of branded and generic medicines into account. As pharmacy owners receive different rates of discount on branded medicines compared to generic medicines, the ‘dispensing mix’ has a significant impact on the total amount of discount pharmacy owners receive.

The new system was calibrated such that the overall amount of deduction applied to pharmacy payments would be the same as the previous system, on the national scale. However, at the individual pharmacy level, many pharmacies will experience a change in the amount of deduction they experience. This is by design.

As the new system splits medicines into different groups with different rates of discount, the dispensing mix of each pharmacy will now directly impact how much deduction they experience, resulting in a fairer level of deduction for all pharmacies.

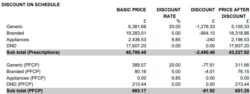

The ‘Discount on Schedule’ section of the monthly FP34 Schedule of Payments shows a breakdown of discount deduction by group for all prescription supplies. The image below shows how the discount deduction breakdown appears in the monthly Schedule of Payments.

The Schedule of Payments also shows the discount deduction split between different product groups for supplies made under the Pharmacy First service (labelled PFCP).

Certain products are exempt from discount deduction, and these are known as Discount Not Deducted (DND) items i.e. reimbursement for these products will have no discount deduction applied. The list of DND items in Part II of the Drug Tariff is updated monthly by the DHSC and includes grouped and individual items.

For a list of all the monthly changes to the DND status of products please see the following page Notice of changes to discount not deducted (DND) status of products.

Pharmacy teams can also check the Actual Medicinal Product pack (AMPP) listing on the NHS Dictionary of Medicines and Devices (dm+d) to identify whether a product has DND status. The eligibility criteria for entry to the DND list is outlined below:

Group items

Any products covered by the definition of one or more of the Group items categories listed below are reimbursed without any discount deduction applied.

- Concessionary Price products (applicable only for the dispensing month(s) for which the product is on concession)

- Cold Chain Storage (ALL)

- Schedule 1, 2 or 3 Controlled Drugs: Products containing drugs listed in Schedules 1, 2 and 3 of the Misuse of Drugs Regulation 2001

- Cytotoxic or Cytostatic item (ALL):

- Immunoglobulins (ALL)

- Insulins for injection (ALL)

- Vaccines and antisera (ALL)

- Unlicensed medicines: ‘Specials’ not listed in Part VIIIB and Part VIIID where the product has been sourced from a supplier holding a MHRA specials or importers licence (prescriptions must be endorsed with invoice price less discount/rebate)

- Hazardous chemicals

Individual items

Individual DND items are listed separately in Part II of the Drug Tariff. Any items covered by the ‘Group Items’ headings are not listed again individually in Part II.

Products not covered by the definition of any Group item DND categories above must fulfil all three of the following Individual Items DND criteria to qualify for exemption from discount deduction:

- the manufacturer(s), AAH and Alliance do not offer pharmacy owners a discount

- fewer than 500,000 items per year are dispensed of the product

- average Net Ingredient Cost (NIC) per item is more than £50

The NIC per item is the average reimbursement value of the prescribed item (NIC/item) and not the Drug Tariff basic price or NHS list price of the product. As the NIC is based on the quantity of the product dispensed, it is independent of product pack size.

Please note: If a product is listed generically in the Individual items DND list, any equivalent branded products are also treated as exempt from discount deduction and not listed separately. However, there may be occasions where a particular branded product meets the Individual item DND criteria but other equivalent brands or generics do not. In this case, only the eligible branded product will be listed in Part II and its generic description will not be included in the list.

Endorsements

Pharmacy owners are NOT required to apply any prescription endorsements to claim exemption from discount deduction for eligible products. The NHSBSA automatically recognises products granted DND status and will not apply any discount deduction to these.. Any endorsements applied by the pharmacy such as ‘DND’, ‘DNG’ or ‘ZD’ will be ignored by the NHSBSA during prescription pricing.

Application for inclusion to the DND list

To make a request for a product to be included in the DND list, please write to ds.team@cpe.org.uk. A member of the Community Pharmacy England Dispensing and Supply Team will investigate whether the product(s) meets the DND criteria and where appropriate, make an application to the Department of Health and Social Care for the product to be granted DND status.

Q. Can I endorse ‘ZD’/‘DNG’/’DND’ to claim exemption from discount deduction for unlicensed medicines?

The ‘ZD’/‘DNG’/’DND’ endorsements are no longer in use as exemption from discount deduction is now automatically applied by the NHSBSA. Any ‘ZD’/‘DNG’/’DND’ endorsement will be ignored by the NHSBSA during processing. All unlicensed medicines not listed in Part VIIIB or Part VIIID of the Drug Tariff where the product has been sourced from a supplier holding a MHRA specials or importers licence are automatically exempt from the discount deduction. Please see the unlicensed specials and imports page for further information.

Q. Are borderline substances eligible to be added to the list?

Borderline substances (ACBS) are no longer automatically added to the list, and will need to meet the DND eligibility criteria listed above.

Q. How was the criteria for products to be included in the list developed?

DHSC published the proposed criteria in their consultation document on this issue. The criteria is intended to reflect those classes of product that require special handling by wholesalers and therefore which have additional supply chain costs. Click on the links below to view the Department of Health and Social Care consultation on this issue and the Community Pharmacy England Response:

Proposals to simplify the reimbursement arrangements for NHS dispensing contractors: A consultation (PDF)

Community Pharmacy England Response to Drug Tariff Simplification Consultation (PDF)

DHSC Summary of Responses to the DT Consultation (PDF)

Q. Methotrexate Tablets 10mg are considered cytotoxic but I can’t see them listed in the new list. Are they exempt from discount deduction?

Yes, all cytotoxic and cytostatic items are exempt from discount deduction, regardless of whether the prescription has been written by brand or generic name. These products aren’t listed individually in the list but can be found under the group heading ‘Cytotoxic or Cytostatic items’.

Notice of changes to discount not deducted (DND) status of products

Briefing 009/25: Discount Deduction Scale

For more information on this topic please email comms.team@cpe.org.uk